Last day’s summary – for 1 kW installed capacity:

Last month’s summary – for 1 kW installed capacity:

I kW reference solar PV capacity - Source: Eurelectric.

Welcome to Respondo AS

Respondo AS is a company that works in the fields of identifying,

financing and managing Virtual Solar Power Plants.

Green transition, or green restructuring, generally means change in a more environmentally friendly direction.

News Services

Many of our customers find it very useful to follow news about renewable energy, power prices, environmental policy and not least the development of solar energy.

We have therefore established our own news service, which will, through continuous monitoring of the most important news media and analysis environments, keep customers up to date.

This news will make it easier for customers to make sensible choices when it comes to participating in various projects.

Customers also gain a better insight into why at certain times there is high income from the projects, while at other times there may be less to earn.

The news service also provides insight into energy and environmental policy and a better understanding of how important such investments are for future generations.

Latest news - Market information

Four years of managing Virtual Power Plants - Results

One of the most important features of our Virtual Power Plants is that the contracts are simple and standardized. This is in contrast to many other power contracts, which are often unnecessarily complicated and extensive and differ from player to player.

We have chosen to base the power contracts on the internationally recognized standard of the European Federation of Energy Traders (EFET) as well as on standard contracts used by various crowdfunding platforms.

Respondo’s management has been active in the international power market since 1992 and cannot emphasize enough the importance of contracts being simple and standardized while taking into account the rights and obligations of the parties.

The contracts can be purely financial without the power being delivered, or they can include the physical delivery of the power at an agreed location/meter.

As background information, you will find here excerpts with principles for pricing and the delivery of Certificates of Origin. The full contract text can be sent on request.

About Respondo AS

Respondo was established in 2012 with a clear mission:

To introduce new ways to participate in emission-reducing projects and give all types of actors easy and direct access to renewable energy and energy efficiency with good long-term returns.

Respondo’s team has worked for over 40 years in power trading, energy efficiency and financing of renewable energy with a background in the Nordic power market and experience from a number of international establishments.

Since 2014, we have initiated and managed several projects, including upgrading heating plants. Introduction of LED lighting and various projects within renewable energy.

Together with existing partners of Respondo, we have since 2021manageg several innovative projects within solar energy in Spain, so-called Virtual Solar Power Plants (VSPP).The portfolio also includes hybrid virtual power plants.

From 2026 we will open the possibility for new customers to engage in Virtual Solar Power Plants, solar in combination with batteries.

What is a Virtual Solar Power Plant?

A virtual power plant is a contract that is often used in the professional electricity market and is now available to the public for the first time.

You will own a so-called Virtual Solar Power Plant (VSPP).

Since the sun in Spain can generate electricity equivalent to about 2,000 hours of full power each year, this gives you as the owner of a 1 kW VSPP up to over about 2,000 kWh each year, which you can sell to the market.

You will buy the virtual plant at market price and then sell the power on the electricity market, just like all other owners of solar power plants.

As a buyer and investor in such a contract, you sell the solar power at market prices and receive the income every month.

You will also receive green certificates of origin that document that you are the owner of green energy and that this reduces your carbon footprint. The reduction in CO2 emissions is also calculated and documented.

Bespoke platform for transactions of Virtual Power Plants.

Respondo will from 2026 introduce a bespoke platform for transactions of Virtual Power Plants. The prototype, to be used purchasing VSPPs and also for loan financing of projects, a solution can be viewed here.

This platform will make it possible to handle large number of customers with low transaction costs .

🔋🔌Combined Solar and Battery - a so-called VHPP.

Respondo is now introducing a pilot project on integrated solar energy, i.e. VSPP, and battery, a so-called hybrid power plant, VHPP.

This involves installing a battery that uses solar energy to charge the battery when the price is lowest in the middle of the day and sells it in the evening, when the price is high.

The costs of batteries have dropped significantly in recent years and such hybrid power plants are now the new normal in Spain and several other countries.

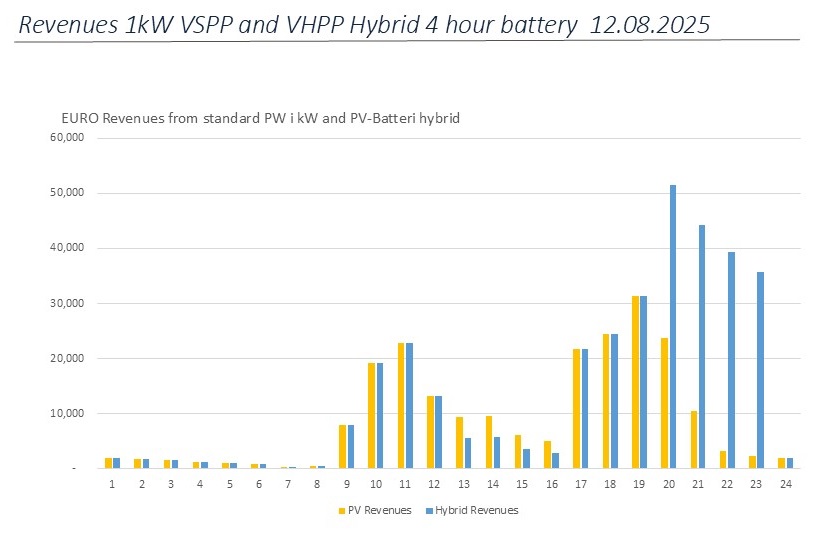

On the website you will now find daily reports on the income from a hybrid power plant, VHPP, which consists of a 1 kW solar panel and a battery with 0.25 kW power and storage of 1 kWh. This means that the battery is charged during the 4 hours with the lowest price and drained during the 4 hours with the highest price.

Respondo is developing an optimization system for charging and draining based on artificial intelligence, AI.

The founders

Experienced entrepreneurs

who have established and led successful international companies in energy and finance

Outstanding

network after 40 years in the energy sector

Experience from

energy investments from a number of countries

Experience from

strategies from development and marketing from digital platforms

Experience from

power markets, industrial companies, ministries and international organizations and with relationships with important decision-makers

Experience from

loan and insurance products and crowdfunding companies

Frequently used

speakers at international conferences and seminars

The Respondo Power Market Model

Respondo uses a supply and demand market balance model to analyse price scenarios in a 39 year perspective and with hour-hour price estimates.

The model is used for trading strategies for solar/battery solutions (BESS) optimization, for investment analysis and estimating effects on CO2 emissions.

We need new innovative financing solutions

After decades of experience in both the energy and financial sectors, the team behind Respondo realized that there was one element missing:

how to mobilize the smaller projects and the smaller investors.

Until now, there have been insufficient effective alternatives for individuals and small businesses to participate in climate projects.

Our vision has therefore been to establish a platform where everyone can participate in the green energy market.

The difference between buying green stocks and a VSPP

The difference between buying green stocks and a VSPP

The green stock market has been very challenging in recent years, but this is often due to unrealistic valuations at IPOs, again based on optimistic plans for the future.

The values in a typical listed solar energy company usually consist of both plants in operation and plants that are under planning and where it is uncertain whether they will be built and how profitable they will be.

The risk in such shares is therefore significantly higher than in a pure production company.

Several green stocks are also in sectors with new and unproven technology.

An investment in a VSPP is based on actual production from solar panels and the cash flow is from sales to the market. A VSPP is therefore a different class to most green stocks.

A VSPP provides exposure directly to the electricity price for the buyer. It also provides risk reduction and financing for the seller.

The financial outcome of purchasing a VSPP is therefore directly linked to developments in the power market.

But this does not mean that a VSPP is without risk!

The energy market is very volatile and there is a risk that money can be lost.

Development of solar energy reduces CO2 emissions

In all VSPPs, daily reports are provided that documents how the solar energy generation from your VSPP gives reductions in your carbon footprint.

On the other hand, the estimates for CO 2 emissions from electricity are very uncertain and depend on the methods used – based on the origin of the electricity supply.

We have therefore developed a complete and comprehensive analysis model that can document the reduction of the carbon footprint.

The model will improve existing estimation and reporting methods and models for estimating carbon footprint reduction.

A historical look back to the year 2000 (YouTube video in Spanish)

Respondo’s history stretches back over 30 years, based on the experience from, among other, the SKM Group Energy Brokers and traders.

Here is a news clip on Euronews that describes how the European power market was developed from the 1990s, lead by SKM Energy Group, which in every way is the very origin of Respondo today.